This infographic is for everyone who wish to understand e-wallet insights & landscape in Malaysia, even for those who are new to mobile payment.

While we have written a piece of very in-depth and lengthy e-wallet insights in Malaysia here, the infographic we are presenting here is sort of like a compressed version.

Hopefully with this light-weight version of e-wallet infographic, it will be easier for even beginners to get a grasp of what's going on with e-wallet landscape in Malaysia.

Before we start, you can also view the full infographic at our Pin here.

E-wallet is like the digital equivalent of your real-world physical wallet.

It appears as an app on your smartphone.

E-money is like our money either in the form of coins or notes.

It appears as a digital number inside an e-wallet.

Note: Only e-wallet providers who issue e-money which can be used with multiple merchants (technically known as "open-loop") will require an e-money license from the Bank Negara Malaysia.

It stores digital money on the cloud.

Examples: WeChat Pay, Grab Pay, Boost, Touch 'n Go e-wallet.

It rides on an existing card network like Visa, Mastercard, China UnionPay.

Examples: BigPay, MPay WALET, AEON Wallet, Merchantrade Money e-wallet.

Note: Both types of e-wallets issue e-money and can be open-loop (possible to pay other merchants).

At the time of writing, there are 42 licensed e-money issuers:

There are generally 4 ways to top-up your e-wallet in Malaysia:

All your account information is encrypted, which means the actual account numbers aren't stored on your phone.

Password / passcode is required when you wish to change / view account information or make any purchase or transaction.

There are plenty of promotions available by using e-wallets.

Promotions such as discounts, good deals, cash rebate, reward points, petrol cash back etc.

No more fumbling over cash and coins.

Once your payment is made, the transaction is recorded automatically in your e-wallet apps.

It is easy to transfer / send money to different accounts.

It is convenient to split the bills with your colleagues or friends.

It is easy to make payment for street parking, no more scratching parking coupons or paying with coins at the parking machine.

Save time, save paper and save the world.

Best exchange rate offered (direct pay via Mastercard / foreign ATM withdrawal).

Zero-processing fee for AirAsia air ticket purchase via Big Pay.

You can check and manage your balance and transaction history using Touch 'n Go e-wallet easily.

Of course, this is only supported by Touch 'n Go e-wallet.

You can also view the full infographic at our Pin here.

Interested to know more and following up on the trends and insights for e-wallet? Join the e-wallet Malaysia FB group by ecInsider now!

Hopefully with this light-weight version of e-wallet infographic, it will be easier for even beginners to get a grasp of what's going on with e-wallet landscape in Malaysia.

Before we start, you can also view the full infographic at our Pin here.

What is e-wallet vs e-money?

What is e-wallet?

E-wallet is like the digital equivalent of your real-world physical wallet.

It appears as an app on your smartphone.

What is e-money?

E-money is like our money either in the form of coins or notes.

It appears as a digital number inside an e-wallet.

Note: Only e-wallet providers who issue e-money which can be used with multiple merchants (technically known as "open-loop") will require an e-money license from the Bank Negara Malaysia.

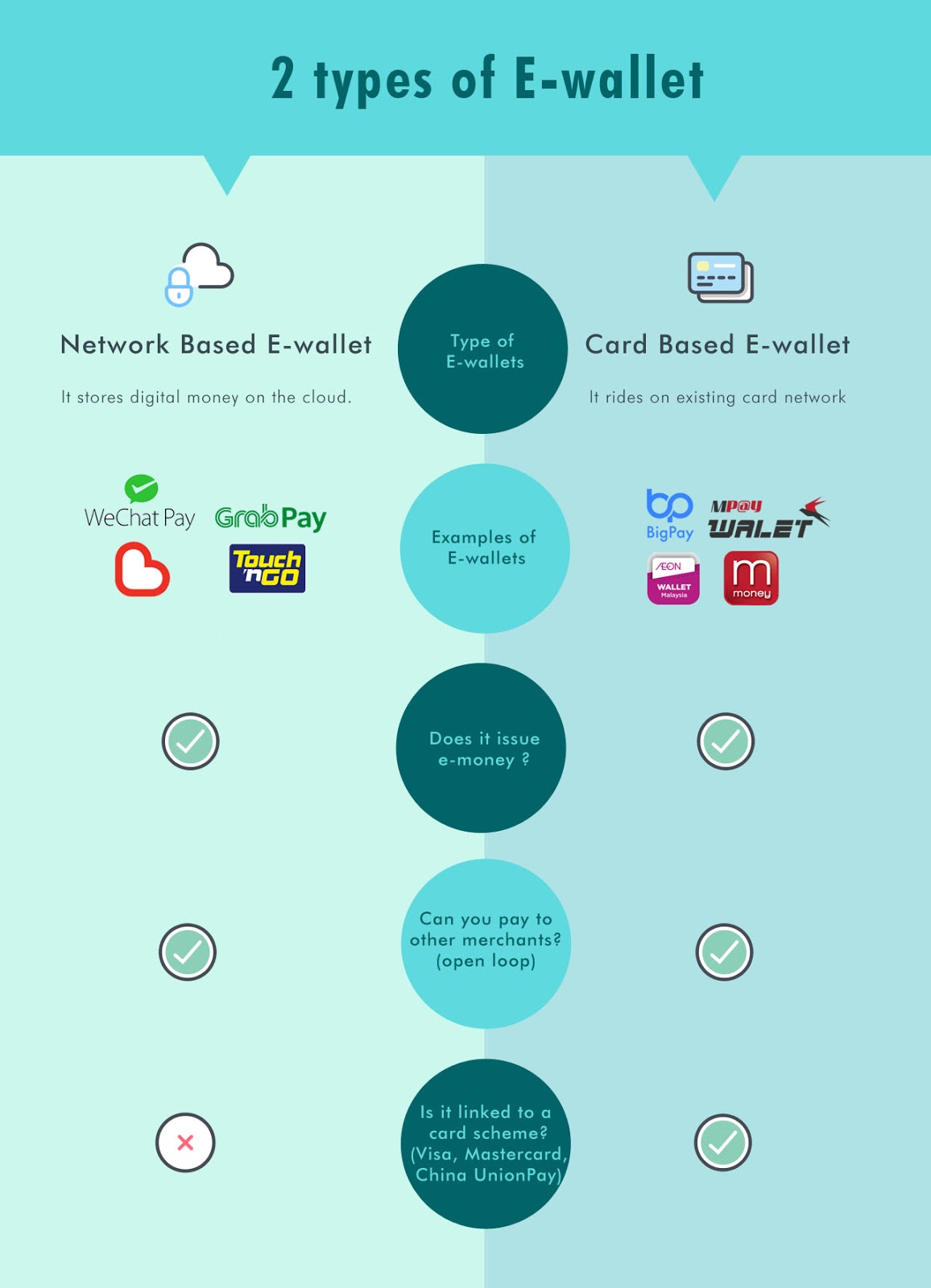

Types of e-wallet

Network-based e-wallet

It stores digital money on the cloud.

Examples: WeChat Pay, Grab Pay, Boost, Touch 'n Go e-wallet.

Card-based e-wallet

It rides on an existing card network like Visa, Mastercard, China UnionPay.

Examples: BigPay, MPay WALET, AEON Wallet, Merchantrade Money e-wallet.

Note: Both types of e-wallets issue e-money and can be open-loop (possible to pay other merchants).

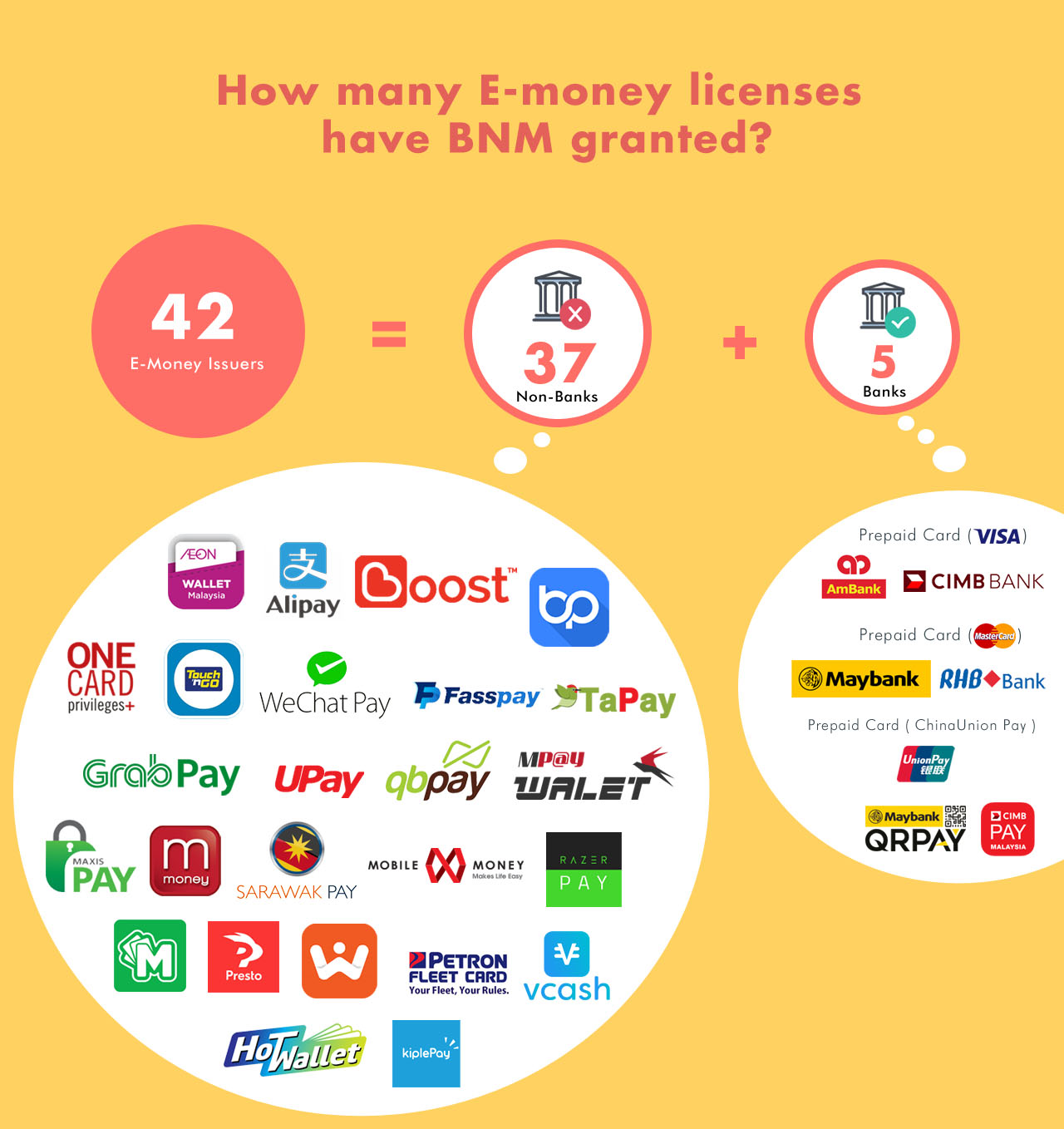

How many e-money licenses have BNM granted?

At the time of writing, there are 42 licensed e-money issuers:

- 37 of them are non-banks

- 5 of them are banks

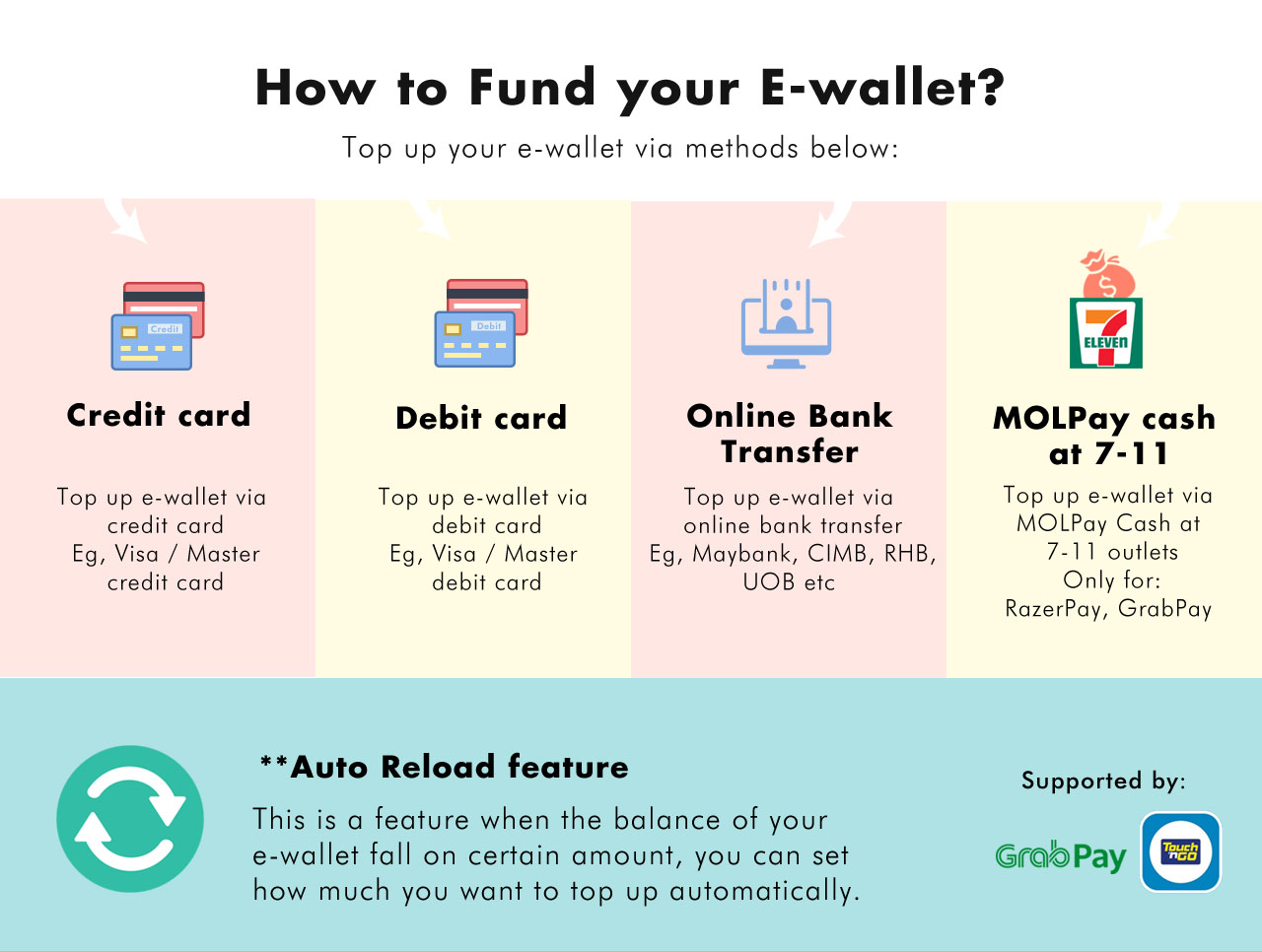

How to fund your e-wallet?

There are generally 4 ways to top-up your e-wallet in Malaysia:

- Credit card: Top-up e-wallet via Visa or Master credit card.

- Debit card: Top-up e-wallet via Visa or Master debit card.

- Online bank transfer: Top-up e-wallet via online baking like Maybank, CIMB, RHB, UOB etc.

- MOLPay cash at 7-11: Top-up e-wallet via MOLPay cash at 7-11 outlets, only for RazerPay, GrabPay for now.

Why use e-wallet?

Secure & Safe

All your account information is encrypted, which means the actual account numbers aren't stored on your phone.

Password / passcode is required when you wish to change / view account information or make any purchase or transaction.

Promotions

There are plenty of promotions available by using e-wallets.

Promotions such as discounts, good deals, cash rebate, reward points, petrol cash back etc.

Convenience

No more fumbling over cash and coins.

Once your payment is made, the transaction is recorded automatically in your e-wallet apps.

Easy Transfer

It is easy to transfer / send money to different accounts.

It is convenient to split the bills with your colleagues or friends.

Easy Parking

It is easy to make payment for street parking, no more scratching parking coupons or paying with coins at the parking machine.

Save time, save paper and save the world.

Save Cost

Best exchange rate offered (direct pay via Mastercard / foreign ATM withdrawal).

Zero-processing fee for AirAsia air ticket purchase via Big Pay.

Touch 'n Go RFID toll payment

You can check and manage your balance and transaction history using Touch 'n Go e-wallet easily.

Of course, this is only supported by Touch 'n Go e-wallet.

You can also view the full infographic at our Pin here.

Interested to know more and following up on the trends and insights for e-wallet? Join the e-wallet Malaysia FB group by ecInsider now!

COMMENTS