LHDN has clarifies that payments made to Google and Facebook for advertising fall under the scope of royalty, instead of payment for services

- [message]

- Update 1: 2 days after this article is published, LHDN has released a statement on 29 Sep 2017. However, the statement is still inconclusive and advertisers are advised to refer to LHDN for clarification, which we did for the past few months. It is good to hear that LHDN will release an official guideline on this, like everyone in the industry this is what we need, and we hope LHDN will reconsider the execution of WHT to not burden local businesses.

Update 2: LHDN has issued another note on 16 March 2018, read it here.

Update 3: LHDN has issued a PR on 5 December 2018, read it here.

Update 4: LHDN has issued the Guidelines on Taxation of Electronic Commerce Transactions on 13 May 2019, read it here.

- What is withholding tax, and the amendment in 2017?

- Should, and can we withhold payments to Google, Facebook & co?

- Can Google & Facebook invoice us from the local entity?

- Is Double Taxation Agreement the saviour?

- Yay! 0% WHT for Google, but how about Facebook?

- How to calculate WHT for Facebook advertising?

- Conclusion: Help yourself, or expect help?

A quick recap here on the expansion of Withholding Tax (WHT) on payment for services and royalty, effective from 17 January 2017:

- The scope of WHT on payment for services has been expanded, which means services rendered by a non-resident taxpayer to a Malaysian resident are subject to WHT regardless where the services were physically performed.

- The definition of royalty has been expanded to include items such as software and communication via satellite. Such amounts are from now on, subject to 10 % WHT which may be reduced under tax treaties.

Since the announcement early this year, the industry players have been trying to justify that digital advertising doesn't fall under "payment for services" hence no WHT applies.

Nevertheless, our months' of findings and communications earlier shown that digital advertising is classified under "payment for services", hence the WHT rate as below:

- 0% WHT for Google advertising (exempted after DTA with Singapore)

- 10% WHT for Facebook advertising (no DTA exemption with Ireland)

Is this correct? Read on to find out...

Does digital advertising fall under "payment for services"?

However, everything changed when I got this reply from a senior LHDN officer (who preferred not to be named here) a week after the previous article was published:

In the email above, it was mentioned that payments made to Google and Facebook for advertising fall under the scope of royalty, instead of payment for services.

Having caught by surprise, I arranged a meeting to discuss this matter with the senior LHDN representative above. I have to thank her here for spending the time to explain in great details.

You might be wondering too, why advertising is being classified as royalty (which is commonly used for copyright usage) instead of services?

In fact according to LHDN website, royalty is defined as any sums paid as consideration for the use of or the right to use:

- Copyrights, artistic or scientific works, patents, designs or models, plans, secret processes or formulae, trademarks or tapes for radio or television broadcasting, motion picture films, films or video tapes or other means of reproduction where such films or tapes have been or are to be used or reproduced in Malaysia or other like property or rights.

- Know-how or information concerning technical, industrial, commercial or scientific knowledge, experience or skill.

- Income derived from the alienation of any property, know-how or information mentioned in above paragraph of this definition.

Google & Facebook advertising is more like the usage of self-service software

That's right, at least to the definition of LHDN.

The moment I met the senior LHDN officer, she has already done her research and understanding on how Google Adwords works.

"Google AdWords enables advertisers to login and create advertising campaigns," she said. "Yeah, advertisers or agencies will need to self-service and run the campaigns," I added.

"You said it yourself, 'self-service' is the keyword here, Google (or Facebook) does not need to manually serve and service you manually, it's all done by the software hence this should be classified under royalty instead of services," she reasoned.

"Yes, we are aware that there is support by Google and Facebook but it is free, or at least being covered if you are the advertisers," she added.

Whether you like it or not, subjective or not, the justification by LHDN on the use of Google and Facebook advertising software (instead of services rendered) does make sense.

Therefore, payment for Google and Facebook is now defined as royalty for the use of self-service Google AdWords and Facebook Business Manager respectively.

However, it is still unclear whether other SaaS, Internet services like shopping cart solutions, cloud storage, marketing tools are all classified under royalty.

- [message]

- You might want to read this too:

It is 8% WHT for both Google & Facebook advertising

Instead of the standard 10% WHT required for royalty, we can refer back to the Double Taxation Agreement (DTA) on a reduced rate, you can check the full list here.

As you might already know by now, Google is invoicing from Singapore, while Facebook is billing from Ireland.

By referring to the summarized DTA table above, it is 8% for both Singapore and Ireland under the Royalties column.

Just don't forget that whenever you are making WHT payment, you need to submit Certificate of Residence (COR) as a supporting document, to prove that your vendor is a legally registered business in the country you are claiming under DTA.

You can refer to the sample of Google's COR (Singapore) and Facebook's COR (Ireland) below:

- [message]

- Do you need Google & Facebook Certificate of Residence?

How to calculate WHT for both Google & Facebook advertising?

If you still remember, Google and Facebook don't allow you to withhold 8% of the invoiced amount whenever you make payment.

Royalty or not, this is where the REAL problem lies.

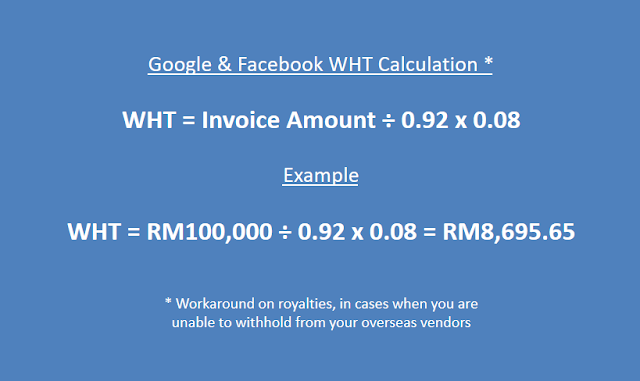

You can ignore the 10% (or ~11.11%) WHT calculation for Facebook in our previous article, and refer to the updated workaround WHT calculation for both Google and Facebook as below:

Just a brief explanation again here, LHDN recognizes RM100,000 as 92% of payment made to Google or Facebook in the example above, hence the need for a workaround calculation.

- [message]

- Effective from the date of publication of this PR (5 December 2018), where withholding tax under section 109B of the ITA is borne by a payer, the withholding tax is to be computed on the gross amount paid to a non-resident. This means that the payment made to the non-resident need not be regrossed to determine the amount of withholding tax.

With the latest guidelines by LHDN above, you no longer need to regross and pay ~8.7% as per our calculation earlier.

In short, you just need to pay 8% WHT of your Google or Facebook media spend, which is RM8,000 in the example earlier if your Google or Facebook invoice is RM100,000.

Additional cost of 8% for businesses to run Google, Facebook advertising

The decision is yours to make, whether to comply with the tax regulation by forking out an additional 8% for WHT on Google, Facebook advertising.

Failing of doing so, you face the potential risks of:

- 10% late WHT payment penalty

- Ineligibility to claim advertising cost as your business expenses in your annual return

- At least 45% penalty on tax avoidance, according to section 113(2) of ITA 1967

It is important to mention again WHT is a good scheme to tax foreign businesses, but the execution is challenging with giants like Google and Facebook who monopolies the market.

This is an on-going dilemma faced not only by Malaysia, but also many countries out there like the latest attempt by the European governments to tax Internet giants in this era of digital economy.

We sincerely hope for Malaysian government to find a good solution to tax foreign Internet software or service provider without burdening local businesses, be it via WHT or some other tax scheme.

The local businesses are contributing to the country's development, via taxes, via hirings, so please don't kill them will ya? Growing a business here is not that hard, but more and more tax compliance is making it super tough nowadays.

COMMENTS