In order to get a better understanding on local market environment, read Part 1 of this installment on mobile commerce in Malaysia which covers the following topics...

In order to get a better understanding on local market environment, read Part 1 of this installment on mobile commerce in Malaysia which covers the following topics:

As for this time, we will explore m-commerce opportunity from the perspective of online retailers, e-commerce providers, platforms etc.

For a start, we need to understand users behaviour on mobile devices and we have some useful analysis from Ericsson ConsumerLab (2012).

From the chart above, Malaysians top 3 activities on smartphone are (in this order):

It is hard to argue that SMS usage will decrease in the future due to the adaption of instant messaging. Not to also miss an interesting observation from McCann's:

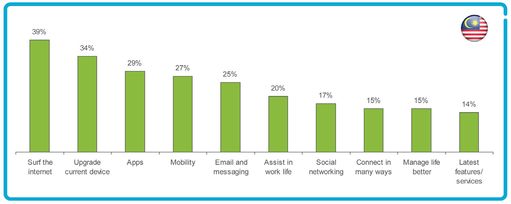

Let's take a look into another chart below on tablet usage in Malaysia.

From the chart above, Malaysians top 3 activities on tablet are (in this order):

It shows that tablet users browse the internet more compared to smartphone, while smartphone users are using instant messaging more often in smartphone.

Which is the best way to reach out to mobile users as an online retailer? Build mobile app or mobile optimized site?

Going back to the smartphone and table user usage behaviour, consumers browse Internet on mobile devices more than using mobile applications. Therefore, it makes better sense to prioritize having responsive design (for both smartphone & tablet) before mobile application.

Furthermore, it is challenging to market and distribute your commerce-oriented mobile application if you don't have a strong brand and pulling power yet.

However, the ability to send users notifications is the main advantage of mobile app. Therefore, it is not surprising that bigger online retailers are using mobile app to engage with their loyal customers. Conversion rates could be higher too on mobile app as compared to those coming from web.

If we are to conclude mobile app vs mobile web debate, it seems that mobile web is suited to acquire new customers while mobile app is more skewed to increase the brand loyalty of existing customers.

There are further evidences by looking at the mobile initiatives of leading online marketplaces in Malaysia.

Note: Data above collected on 6 June 2013

It is interesting to note that all online marketplaces are mobile web optimized with the exception of Lelong.my, who leverages on mobile app to provide better shopping experience to its existing base of customers. Even if you land at Groupon's mobile web you will be encouraged to download and use their mobile application.

On another hand, Lazada and Rakuten are the only 2 major marketplaces without mobile app (as of June 2013). This is not surprising too as both of them are still quite new to the market and it is more important for them to acquire new customers via mobile web.

Updates: Lazada launches mobile app on 12 June.

Therefore, it is important to understand what is your objective before embarking on mobile commerce. Start analyzing your traffic & transaction data, what are the percentages from mobile? Is your objective acquiring new customers, providing convenience to customers, or boosting your customers lifetime value?

And the big question is, how to reach out to mobile users?

We will leave this to another day to ponder, stay tuned!

- Mobile vs Desktop in Malaysia

- Smartphone penetration in Malaysia

- Tablet penetration in Malaysia

- Mobile Commerce market size in Malaysia

As for this time, we will explore m-commerce opportunity from the perspective of online retailers, e-commerce providers, platforms etc.

How do Malaysians consume smartphone, tablet?

For a start, we need to understand users behaviour on mobile devices and we have some useful analysis from Ericsson ConsumerLab (2012).

From the chart above, Malaysians top 3 activities on smartphone are (in this order):

- SMS - 91%

- Browse Internet - 71%

- Social Network - 69%

It is hard to argue that SMS usage will decrease in the future due to the adaption of instant messaging. Not to also miss an interesting observation from McCann's:

Malaysians were one of the most active users when it comes to smartphones with an average of 6.4 hours spent in a week on just data usage, which means no voice or telephone calls were made during these times.That means, Malaysian smartphone users spend close to 1 hour a day purely on data.

Let's take a look into another chart below on tablet usage in Malaysia.

From the chart above, Malaysians top 3 activities on tablet are (in this order):

- Browse Internet

- Upgrade current device

- Apps Usage

It shows that tablet users browse the internet more compared to smartphone, while smartphone users are using instant messaging more often in smartphone.

Mobile application, or mobile web (responsive web design)?

Which is the best way to reach out to mobile users as an online retailer? Build mobile app or mobile optimized site?

Going back to the smartphone and table user usage behaviour, consumers browse Internet on mobile devices more than using mobile applications. Therefore, it makes better sense to prioritize having responsive design (for both smartphone & tablet) before mobile application.

Furthermore, it is challenging to market and distribute your commerce-oriented mobile application if you don't have a strong brand and pulling power yet.

However, the ability to send users notifications is the main advantage of mobile app. Therefore, it is not surprising that bigger online retailers are using mobile app to engage with their loyal customers. Conversion rates could be higher too on mobile app as compared to those coming from web.

Are local online marketplaces and retailers ready for mobile?

If we are to conclude mobile app vs mobile web debate, it seems that mobile web is suited to acquire new customers while mobile app is more skewed to increase the brand loyalty of existing customers.

There are further evidences by looking at the mobile initiatives of leading online marketplaces in Malaysia.

| Marketplace | Mobile app | Mobile web |

| Lelong.my | Yes | No |

| Qoo10 | Yes | Yes |

| eBay | Yes | Yes |

| Rakuten | No | Partial |

| Lazada | No | Yes |

| Zalora | Yes | Yes |

| Groupon | Yes | Yes |

| LivingSocial | Yes | Yes |

It is interesting to note that all online marketplaces are mobile web optimized with the exception of Lelong.my, who leverages on mobile app to provide better shopping experience to its existing base of customers. Even if you land at Groupon's mobile web you will be encouraged to download and use their mobile application.

On another hand, Lazada and Rakuten are the only 2 major marketplaces without mobile app (as of June 2013). This is not surprising too as both of them are still quite new to the market and it is more important for them to acquire new customers via mobile web.

Updates: Lazada launches mobile app on 12 June.

How to do more on mobile commerce?

Therefore, it is important to understand what is your objective before embarking on mobile commerce. Start analyzing your traffic & transaction data, what are the percentages from mobile? Is your objective acquiring new customers, providing convenience to customers, or boosting your customers lifetime value?

And the big question is, how to reach out to mobile users?

We will leave this to another day to ponder, stay tuned!

COMMENTS