We have shortlisted top 10 online shopping sites (e-marketplaces) in Malaysia recently, here we are going to analyze the site engagement and traffic sources of these popular e-commerce websites.

We have shortlisted top 10 online shopping sites in Malaysia earlier (note: we have updated the top 10 list so it might not be the same list here), here we are going to analyze the site engagement and traffic sources of these popular e-commerce websites.

First of all, let's recap the top 10 list below in terms of visits, time on site, page views and bounce rate. Do take note that this is an analysis on desktop visits only, which is about 50% to 60% of a typical online shopping site when we exclude mobile visits.

If we compare among the top 10 sites, 11street scores the highest in terms of average time spent on site (10:54) and number of page views (12.23).

On the contrary, average time spent on Zalora is the lowest (5:18) and average page views on Groupon is the least among all (4.59), probably due to its site design.

Zalora also has the highest bounce rate (visits that land at only one page and left without browsing other pages) at 56.43%. This kind of visits are low value to e-commerce websites and if we remove the bounced visits, Zalora only enjoys ~700,000 meaningful visits via desktop.

Astro Go Shop on another hand has a very impressive and low bounce rate at 18.85%!

If you are not quite sure about this, read on the golden online sales formula first.

What are the key factors behind site engagement or stickiness?

• Quality of traffic (acquisition) which we will examine more after this

• On-site merchandising and on-going promotions

• Website user experience (both desktop & mobile)

We will breakdown the traffic sources of each top 10 online shopping sites in the subsequent sections, from direct, search (organic + paid), display, social to mail.

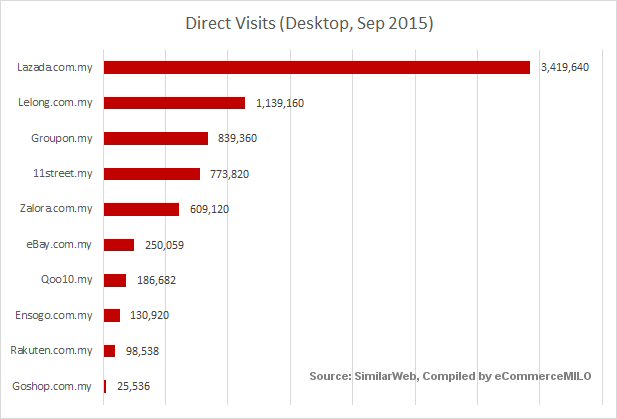

In order to visualize logical comparisons, we will compare the sites on total visits (instead of %) by channels. For example, 37.17% of traffic to Lazada is via direct visits so it will be 9,200,000 x 37.17% = 3,419.640 direct visits.

Again, by no means this is the actual visits by channel to respective website as the data source covers only desktop visits, but still it is good to compare the top e-commerce sites against each other.

With significant firepower in recent years, there is no doubt that Lazada has dethroned Lelong as the king of e-marketplace in Malaysia.

Lazada has started to reap the rewards from heavy marketing investment as they are far ahead from the rest in terms of total and direct traffic (which also originates from bookmark, returning visits).

High direct traffic also translates into stronger brand awareness and engagement, which is a reason why Groupon is at #3 spot here being a household name among online shoppers here.

Lelong enjoys the highest traffic from organic (non-paid) search, followed by Lazada and Zalora.

One of the obvious reason behind Lelong's strength in SEO is the site domain / business history with more than 17 years old!

Of course, number of SKUs / product pages is the key behind organic search superiority. Don't believe? Lelong has 1,130,000 pages indexed by Google while Lazada has only 267,000 pages indexed at the time of writing.

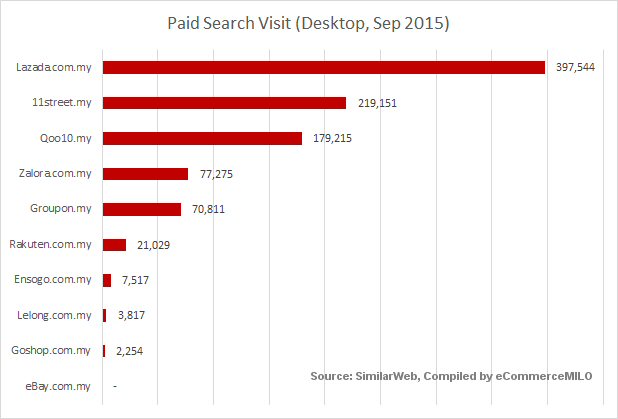

Who are the e-commerce advertisers most loved by Google? The answer is Lazada, 11street, Qoo10 and Zalora as they are the top 4 sites with most traffic coming from Search Engine Marketing (SEM) a.k.a. AdWords.

Ironically, all 4 of them are either originated, (majority) owned by ventures from Germany and South Korea. eBay from US is the only site in top 10 without any advertising spend on Google search.

If you estimate cost per paid search visit at just RM1, can you guess how much is their monthly spend on SEM? Don't forget that the figures above only covers desktop without mobile.

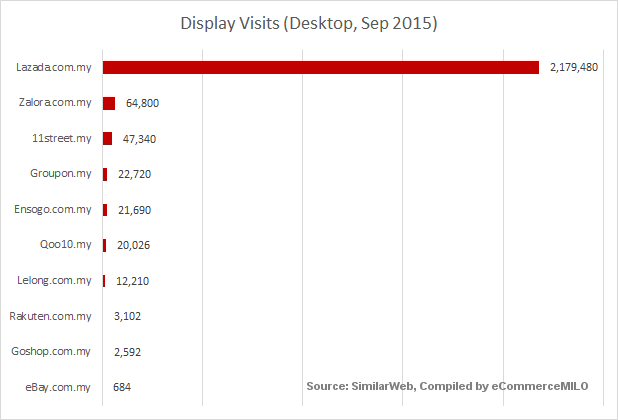

Display advertising in short is banner advertising via Google Display Network, Criteo (programmatic remarketing) and affiliate networks.

Besides programmatic, traffic quality in general is lesser via display advertising as this is more skewed to brand awareness instead of conversions, or simply getting loads of cheaper traffic via affiliate network that leverages on irrelevant publisher sites.

That explains why the top 2 sites with highest display visits also have the highest bounce rate, especially Lazada with big chunk of traffic coming from affiliate network like Adcash.

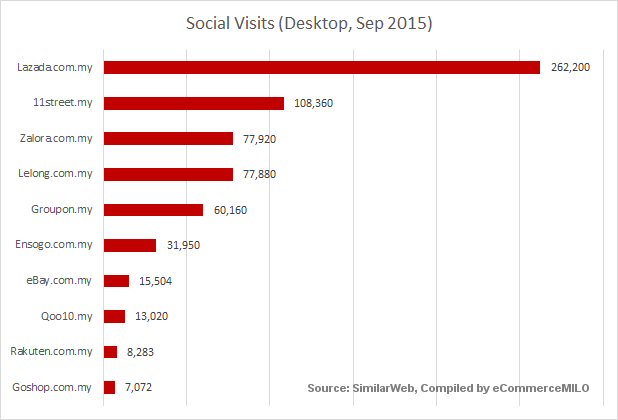

Social commerce any one? All top sites acquire only less than 10% desktop visits from social media, except for Ensogo with slightly more than 10% originated mostly from Facebook.

Social media in this definition includes Facebook, YouTube, Twitter, Instagram etc. Of course, the figure presented here is limited to desktop only and audience are using social media on mobile more than desktop.

If big part of the social visits are paid, who are the e-commerce advertisers most loved by Facebook?

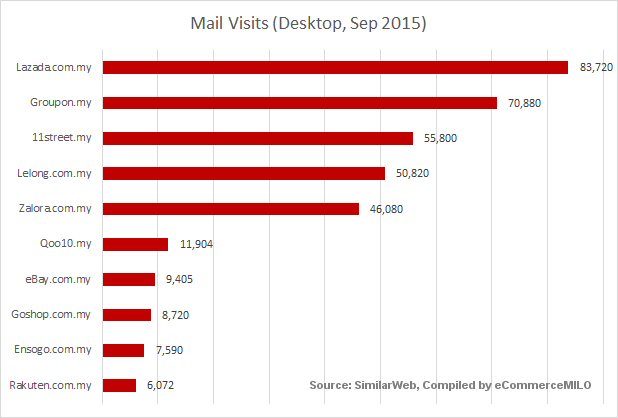

Groupon as we would have expected ranks highly in the email newsletter section, second in the list just behind Lazada.

Subscriber base, EDM blast frequency, email promo subject and content are the key factors contributing to the mail visits here.

Interesting to see Astro Go Shop crawling up in the ranking here leveraging on their existing Pay TV subscribers. Astro subscribers arguably consists of slightly different consumer segment or demographics compared to the rest, it is just how many of their 4.4 million+ subscribers are actively checking emails or even shop online?

Of course, alternatively those subscribers can shop via TV!

First of all, let's recap the top 10 list below in terms of visits, time on site, page views and bounce rate. Do take note that this is an analysis on desktop visits only, which is about 50% to 60% of a typical online shopping site when we exclude mobile visits.

11street has the highest site engagement

If we compare among the top 10 sites, 11street scores the highest in terms of average time spent on site (10:54) and number of page views (12.23).

On the contrary, average time spent on Zalora is the lowest (5:18) and average page views on Groupon is the least among all (4.59), probably due to its site design.

Zalora also has the highest bounce rate (visits that land at only one page and left without browsing other pages) at 56.43%. This kind of visits are low value to e-commerce websites and if we remove the bounced visits, Zalora only enjoys ~700,000 meaningful visits via desktop.

Astro Go Shop on another hand has a very impressive and low bounce rate at 18.85%!

Quality traffic + high site engagement = strong sales!

If you are not quite sure about this, read on the golden online sales formula first.

What are the key factors behind site engagement or stickiness?

• Quality of traffic (acquisition) which we will examine more after this

• On-site merchandising and on-going promotions

• Website user experience (both desktop & mobile)

We will breakdown the traffic sources of each top 10 online shopping sites in the subsequent sections, from direct, search (organic + paid), display, social to mail.

In order to visualize logical comparisons, we will compare the sites on total visits (instead of %) by channels. For example, 37.17% of traffic to Lazada is via direct visits so it will be 9,200,000 x 37.17% = 3,419.640 direct visits.

Again, by no means this is the actual visits by channel to respective website as the data source covers only desktop visits, but still it is good to compare the top e-commerce sites against each other.

Lazada enjoys the highest direct visits

With significant firepower in recent years, there is no doubt that Lazada has dethroned Lelong as the king of e-marketplace in Malaysia.

Lazada has started to reap the rewards from heavy marketing investment as they are far ahead from the rest in terms of total and direct traffic (which also originates from bookmark, returning visits).

High direct traffic also translates into stronger brand awareness and engagement, which is a reason why Groupon is at #3 spot here being a household name among online shoppers here.

Lelong is still the best in SEO

Lelong enjoys the highest traffic from organic (non-paid) search, followed by Lazada and Zalora.

One of the obvious reason behind Lelong's strength in SEO is the site domain / business history with more than 17 years old!

Of course, number of SKUs / product pages is the key behind organic search superiority. Don't believe? Lelong has 1,130,000 pages indexed by Google while Lazada has only 267,000 pages indexed at the time of writing.

Who are the biggest AdWords spenders?

Who are the e-commerce advertisers most loved by Google? The answer is Lazada, 11street, Qoo10 and Zalora as they are the top 4 sites with most traffic coming from Search Engine Marketing (SEM) a.k.a. AdWords.

Ironically, all 4 of them are either originated, (majority) owned by ventures from Germany and South Korea. eBay from US is the only site in top 10 without any advertising spend on Google search.

If you estimate cost per paid search visit at just RM1, can you guess how much is their monthly spend on SEM? Don't forget that the figures above only covers desktop without mobile.

And who spend the most on display advertising?

Besides programmatic, traffic quality in general is lesser via display advertising as this is more skewed to brand awareness instead of conversions, or simply getting loads of cheaper traffic via affiliate network that leverages on irrelevant publisher sites.

That explains why the top 2 sites with highest display visits also have the highest bounce rate, especially Lazada with big chunk of traffic coming from affiliate network like Adcash.

Who invest the most on Facebook?

Social media in this definition includes Facebook, YouTube, Twitter, Instagram etc. Of course, the figure presented here is limited to desktop only and audience are using social media on mobile more than desktop.

If big part of the social visits are paid, who are the e-commerce advertisers most loved by Facebook?

Who have the biggest online shoppers database?

Groupon as we would have expected ranks highly in the email newsletter section, second in the list just behind Lazada.

Subscriber base, EDM blast frequency, email promo subject and content are the key factors contributing to the mail visits here.

Interesting to see Astro Go Shop crawling up in the ranking here leveraging on their existing Pay TV subscribers. Astro subscribers arguably consists of slightly different consumer segment or demographics compared to the rest, it is just how many of their 4.4 million+ subscribers are actively checking emails or even shop online?

Of course, alternatively those subscribers can shop via TV!

COMMENTS